Acquisition project | Smytten

"What if you could try the best beauty, grooming, and lifestyle products—before spending a dime? That’s Smytten. We’ve revolutionized sampling in India, letting consumers discover premium products through risk-free trials, while helping brands turn samplers into loyal buyers

We’re not just India’s favorite sampling platform; we’re also leveraging Smytten Pulse AI to predict what consumers will love next.

We predict trends and personalize recommendations, making discovery smarter than ever. Want to see how sampling can drive your next big decision?"

🌐 Consumer Struggles

- Overwhelming Choice Fatigue: 100+ serums, 50+ protein bars — but which one actually works?

- Lack of Trust Before Purchase: 71% of Indian consumers hesitate to buy premium D2C brands without trying them first (RedSeer, 2023).

- High Cost of Trial: Paying ₹500+ just to try a product deters experimentation, especially for students and entry-level earners.

- Low Personalization: Marketplaces push trends, not personalized curation — making discovery transactional, not experiential.

🙋♀️ User Voice (Testimonial-style insight):

“I love discovering new products, but I’ve wasted so much money buying things I never used after one try.” – A Smytten user, age 23, Mumbai

🎯 Core Promise

“Discover what truly works — before you buy.”

✅ Why It Works

- Try-before-you-buy sampling model reduces buyer hesitation

- 6 trial credits + doorstep delivery = instant gratification + value

- Smart curation via app UX and quiz logic = less scroll, more satisfaction

- Premium-first positioning = attracts high-intent users who are willing to spend after validation

📈 Validation & Industry Proof

- 💡 4M+ app downloads, with high daily retention among women aged 18–35

- 🛍️ 80% of users who sample from Smytten go on to make a full-size purchase (internal claim, if applicable)

- 🌍 The global sampling market is growing at 6.5% CAGR – indicating rising demand for low-risk discovery models

Value Proposition: Enables consumers discover and try premium products before they buy, offering a risk free and personalised experience

Nuances: While the platform caters to multiple categories, 80% of products belong to Beauty and Personal Care category (Skincare, Makeup, Haircare, Bath & Body, Fragrances)

(Go and speak to different users of the product and the people in the chain: households buying the product, shopkeepers selling the product, churned users, and users using competitor's products. In the case of B2B products identify the decision makers, the influencer, the blocker, and the end-user)

Understanding your ICP

(Put down your ICP’s in a Table Format. A tabular format makes it super clear for anyone to understand who your users are and what differentiates them)

We have multiple users of a product and not all of them can be our ICP for whom we make our strategies, we need to prioritize.

(use an ICP prioritization table)

Criteria | ICP 1 | ICP 2 | ICP 3 |

|---|---|---|---|

Occupation | Job oriented, Freelancer, Businessowner, Influencer etc | Job oriented, Business man, Freelancer / Consultant | Home maker, Job, Own small business |

Age | 18-40 | 18-40 | 21-45 |

Geography | Metros and Tier 1 cities of India | Metros and Tier 1 cities of India | Tier 2 cities and Beyond |

Gender | Female | Male | Female |

Social media they use | Instagram, Pinterest, Snapchat, Redditt | Linkedin, Instagram, Redditt, Dream11, Hinge, Netflix | Meta - Instagram and Facebook, Sharechat, Kukufm, Trell, Alt balaji |

Who do they follow | Bollywood celebrities, Sports fanatics, Business or industry leaders | Sportsmen, Business or industry leaders | Bollywood/ Regional celebrities, Local politicians, Sportsman, Educational leaders |

Shopping apps they use | Nykaa, Purple, Amazon, Flipkart, Quick commerce apps, Zomato, Swiggy | Myntra, Ajio, Zomato, Swiggy, Zepto, Nykaa | Meesho, Flipkart, Jiomart, Limeroad |

What do they do for entertainment or in their leisure time? | Chill in a cafe, House party, Take up a new sport, Dance class, Hobby sessions | Go to the gym, Sports, Online gaming, Dining out - Pub/bar | Go to the shopping mall, go to the movies, go for dinner in a restaurant, online gaming |

Marital status | Single, In a relationship or Just Married | Single, In a relationship or Just Married | Single, Married / Married with kids |

Problem statement for all our ICPs are as follows -

- Lack of trust in new products – Users hesitate to buy products without trying, fearing poor quality or mismatch.

- Difficulty discovering relevant brands – Overwhelming choices with no easy way to find what suits individual needs.

- No easy way to trial products – Full-size purchases for testing are costly and inconvenient.

- Generic, impersonal shopping experience – Most platforms don’t tailor discovery or recommendations.

- Complex and cluttered user journey – Long, confusing product exploration and checkout processes reduce engagement.

Understanding Core Value Proposition

What We Do:

Smytten is India’s leading try-before-you-buy platform, empowering consumers to discover and test premium beauty, wellness, health, food & beverage, and lifestyle products—risk-free. For just ₹250, users can curate a trial box with up to 6 samples, enjoy 100% cashback as redeemable credits, and use them toward full-size purchases on Smytten’s e-commerce platform.

- Risk-Free Trials – Pay just ₹250, pick 6 samples you actually want, and get 100% cashback as redeemable credits—so trials feel free.

✅ Curated Discovery – No more random samples. Choose from 5,000+ products across beauty, skincare, health supplements, snacks, beverages, and more.

No Buyer’s Remorse – Only buy full sizes of what you know works.

Problem We Solve:

- For Consumers:

- Eliminates purchase anxiety – No more wasting money on products that don’t work. Try first, buy what you love.

- Democratizes premium access – Affordable trials (₹250 → redeemable) make luxury and niche brands accessible.

- No Reliable Way to Test – Traditional sampling (freebies in magazines or stores) is random, inconsistent, and rarely matches what shoppers actually want.

- E-commerce Returns Are Painful – Even if a product can be returned, the hassle of repackaging and waiting for refunds kills the experience.

- For Brands:

- Replaces wasteful traditional sampling (e.g., random mall giveaways) with a high-intent, data-rich platform that converts trials into sales.

- AI-driven decision-making – Smytten Pulse AI provides real-time insights on trends, sentiment, and competitor benchmarks to optimize marketing and R&D.

Why It’s Unique:

- Largest Trial Ecosystem: 5,000+ samples across beauty, wellness, health, F&B, and more.

- Seamless Commerce Loop: Trials → feedback → full-size purchases (with 20% conversion rate, 2X industry avg).

- Omnichannel Reach: Online + offline "Trial Parks" for immersive discovery.

- Brand Growth Engine: AI-powered ad solutions + research SaaS (Smytten Pulse) cut CAC by 50%+ and speed insights 5X faster.

Result:

A closed-loop discovery platform where consumers shop fearlessly, and brands acquire loyal customers smarter, faster, and cheaper.

| Brand | Type | Sampling Model | Target Audience | Product Categories | Personalization | Content/Influence Layer | USP |

|---|---|---|---|---|---|---|---|

Smytten | Discovery & Sampling App | Yes – trial boxes | Women (18–35), Tier 1/2 metros | Beauty, wellness, food, baby care | Strong | Light (reviews, quizzes) | Premium discovery at low/no cost |

TryKaro | Direct Sampling Platform | Yes – free trials | Value-seeking Gen Z, Tier 2+ | Beauty, personal care, household | Moderate | Light | Zero-cost trials with gamified UX |

MyGlamm (POPxo) | Content-to-Commerce | Yes (limited) | Women 18–30, Tier 1/2 | Own beauty products | Weak | Strong (POPxo, influencers) | Full-stack beauty brand with content push |

Nykaa Samples | E-commerce Marketplace | No (except mini sizes) | Women 22–45, metro | Full beauty & fashion catalog | Medium | Strong (influencers, videos) | Trust + product variety |

Skinnsight / Sublime Life | Niche D2C Beauty Discovery | No | Clean beauty users | Clean beauty/skincare only | Weak | Moderate | Niche curation and sustainable brands |

Amazon / Flipkart | Mass Marketplace | No | Everyone | All categories | Weak | Weak | Speed, availability, pricing |

Sugar Cosmetics | D2C Beauty Brand | Yes (in bundles) | Gen Z and young women | Own makeup & beauty SKUs | Weak | Strong (YouTube, creators) | Bold, accessible makeup for Gen Z |

TAM = Total no. of potential customers x Average Revenue Per Customer (ARPU)

SAM = TAM x Target Market Segment (percentage of the total market)

SOM = SAM x Market Penetration/Share

TAM

| Segment | India Market Size (2026E) | Global Scalability | Notes |

|---|---|---|---|

Product Sampling | $10B (Beauty + Wellness + F&B) | $35B (Asia-Pacific) | Includes beauty, health, food & beverage trial markets |

Consumer Research | $2.5B (India) | $25B (Global) | Market Research Society of India data |

Retail Media Ads | $1B (India) | $10B (Emerging Markets) | In-platform ads + performance marketing. $10B ad spends on retail media" → India = ~10% share (similar to e-commerce ad spend splits) |

Omnichannel Commerce | $5B (India premium D2C) | $20B (Global D2C sampling) | Trial-to-purchase conversions 20% conversion from trials → Applied to India’s premium D2C market ($25B). |

Total TAM (India, 2026): ~$18.5B

Global TAM (2026): ~$90B

SAM

| Segment | SAM (2026E) | Assumptions |

|---|---|---|

Digital Sampling | $2B | 1,200+ brands → Assumes 20% of $10B sampling market is digitized (premium brands). |

Consumer Research | $500M | Targets 20% of research market (SMBs/D2Cs adopting Pulse AI). |

Retail Media Ads | $200M | 20M users → $10 CPM (competitive rate) x 2B impressions annually. |

Total SAM (India, 2026): $2.7B

Assumption: Excludes mass-market/FMCG (traditional sampling) and offline-only brands.

SOM

| Segment | SOM (2026E) | Assumptions |

|---|---|---|

Digital Sampling | $120M | FY27 revenue target = ₹500CR (~$60M) → 50% from sampling (6% SAM penetration). |

Consumer Research | $50M | Pulse AI adoption by 10% of SAM brands (5,000 brands x $10K/year). |

Retail Media Ads | $30M | 350K transacting users → $5 ad revenue/user/year (optimistic but achievable). |

Total SOM (India, 2026): $200M

Assumption: Aligns with Smytten’s growth trajectory (120% YoY, Slide 12) and 75% repeat engagement.

🧠 Smytten’s Competitive Edge

- Only player with a true multi-brand sampling-first model

- Rich product variety beyond beauty (food, wellness, fragrances, baby care, etc.)

- Affordable “try before you buy” experience for aspirational, not just budget-conscious users

- Potential to layer data-driven personalization + gamified engagement

Designing Acquisition Channel

(keep in mind the stage of your company before choosing your channels for acquisition.)

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low (SEO, social) | High (content creation) | Medium (algorithm-dependent) | High (long-term) | Slow (6–12 months) |

Paid Ads | High (CPC/CPM) | Medium (campaign mgmt.) | High (A/B testable) | High (immediate) | Fast (days-weeks) |

Referral Program | Medium (rewards cost) | Medium (program setup) | High (tweakable) | Medium (network-dependent) | Medium (1–3 months) |

Product Integration | Low/Rev-share | High (negotiation) | Low (contract-locked) | High (if scaled) | Slow (3–6 months) |

Content Loops | Low (UGC-focused) | High (community mgmt.) | High (real-time updates) | Viral potential | Medium (3–6 months) |

Organic Channel

(Understand the existing organic channel strategy for your product and highlight the success and failure thereon.

Provide your suggestions and devise new strategies.)

| Channel | Tactics Used | Successes | Failures/Limitations |

|---|---|---|---|

SEO | - Blog posts ("Best trial boxes"). - Category pages (beauty/wellness). | - High traffic for "try before you buy" keywords. - Strong domain authority. | - Low conversion from blog readers to app users. - Limited long-tail keyword focus. |

Social Media | - Instagram/TikTok UGC (unboxings). - Hashtag campaigns (#SmyttenTrials). | - High engagement (4.5% avg. rate). - Viral unboxing videos (50K+ views). | - Low follower growth (~1% MoM). - Minimal link clicks to app. |

Community | - Facebook groups for reviews. - WhatsApp groups for loyal users. | - High retention (75% repeat users). - Authentic word-of-mouth. | - Labor-intensive moderation. - Limited scalability. |

App Store SEO | - Keyword-optimized listings. - Encouraged user reviews. | - 4.4★ rating (800K+ reviews). - Top 5 rankings for "beauty samples." | - Low discoverability for non-beauty terms (e.g., "health samples"). |

Root Causes of Failures

- SEO: Focus on top-funnel content (blogs) without clear CTAs to app downloads.

- Social Media: Engagement ≠ conversions; no incentive to leave platforms.

- Community: Manual effort outweighs growth impact.

- App Store: Over-indexed on beauty, missing wellness/F&B keywords.

New Organic Growth Strategies

1. SEO & Content Loops

Problem: Blog readers don’t convert.

Fix:

- Embed app referral links in blogs (e.g., "Get your trial box here").

- Create interactive content: Quizzes ("Which trial box suits you?") → Capture emails → Retarget.

- Target long-tail keywords: "Affordable health supplement samples in India."

Expected Impact:

- 20% increase in app sign-ups from organic traffic.

2. Social Media → App Funnels

Problem: Engagement stays on-platform.

Fix:

- Link in Bio 2.0: Use tools like Linktree to showcase trial offers + app CTA.

- Incentivized UGC: "Post a trial unboxing → Get ₹50 cashback."

- Shorts/Reels: Quick tutorials ("How to redeem your ₹250 trial credit").

Expected Impact:

- 15% higher CTR to app store.

3. Scalable Community Building

Problem: Manual moderation limits growth.

Fix:

- Automated rewards: Discord/Telegram bots for points (e.g., "Share feedback → Earn credits").

- Brand ambassador program: Power users earn commissions for referrals.

Expected Impact:

- 2X referral-driven sign-ups.

4. App Store Expansion

Problem: Limited to beauty keywords.

Fix:

- Optimize for wellness/F&B: "Protein sample kits," "healthy snack trials."

- Leverage ratings: Prompt users post-trial ("Rate us for extra cashback").

Expected Impact:

- 30% more non-beauty installs.

Content Loop

(Keep it simple and get the basics right)

Step 1 → Nail down your content creator, content distributor and your channel of distribution

Step 2 → Decide which type of loop you want to build out.

Step 3 → Create a simple flow diagram to represent the content loop.

Content Loop | Hook | Generator | Distributor |

Blog | Questions asked on Google | Smytten's in-house team | SEO- through organic search |

Emailer | Receives email in inbox | Smytten's in-house team | Smytten's marketing team |

Reels on topics that are common/ trending. | Smytten's in-house team, influencer collaboration | Instagram (Timeline/Explore tab) Viewer (shared via Stories/DMs) |

We will go with the Instagram due to the reach is much wider and there is high potential for distribution with the existing beauty and fashion influencers and already gives an audience for our exact Target audience

Content Loop Details:

- Content creator: Smytten/Influencers- Content can be created by Smytten's inhouse team on common themes like skin concerns, product types (ex. best sunscreens in India), New launches and viral skincare/makeup tutorials etc. This is in the form of reels which are widely popular and are usually attached with a specific code to track efficacy.

Content can also be created on influencers shopping online but are not able to find the right options to choose from. - The reel is shared among friends to suggest routines/products or a better way to find the right product for you by trying multiple small size products. A wider audience of the sharer discovers Smytten through this route

- They use the special discount code and make purchases, and further spread the word among their Instagram friends/followers and the loop continues.

URL

(Understand what is already being done, what is working out well and what needs to be stopped)

Step 1 → Define the CAC: LTV ratio. If your product has a healthy CAC:LTV ratio, proceed with paid ads.

Step 2 → Choose an ICP

Step 3 → Select advertising channels

Step 4 → Write a Marketing Pitch

Step 5 → Customize your message for different customer segments to ensure relevance

Step 6 → Design at least two ad creatives (e.g., images, sketches, videos, text ads) that reflect your marketing pitch.

Paid digital ads (Meta, Google, Instagram, YouTube, and programmatic) form a key acquisition lever for Smytten to drive app installs and product trials. These ads are targeted at specific user segments (ICPs) with tailored messaging to push discovery of the platform’s core value proposition: “Try before you buy.”

Step 1

- CAC: ₹150–200 (vs. industry ₹700–900)

- LTV: ~₹1,200 (assumes 3 full-size purchases post-trial at ₹400 margin).

CAC:LTV Ratio: 1:6 (Healthy; benchmark is 1:3).

Decision: Proceed with paid ads—scaling is justified.

This healthy ratio suggests that Smytten can afford to scale paid ads profitably, but only if conversion rates post-trial remain strong.

How this Influences Budgeting & Strategy

- Budget allocation is optimized toward channels with lower CAC and high intent, like Google (search) and retargeting campaigns.

- High CAC platforms (e.g., Instagram Reels) are used more for top-of-funnel awareness, but supported with nudge campaigns (push notifications, in-app messages) to bring down effective CAC.

- LTV cohorts by product category (e.g., Beauty vs Gourmet vs Fragrances) guide which SKUs to feature in ads.

Step 2

Primary ICPs:

- Consumers:

- Demographics: Women 18–35, Tier 1–2 cities.

- Psychographics: Beauty/wellness enthusiasts, value-conscious, prefer trying before buying.

- Behavioral: Active on Instagram/YouTube, shop via Meesho/Nykaa.

How ICPs Influence Messaging:

- Young Women: Ads focus on luxury brand access, curated experiences, and social proof (“over 1 million women love Smytten”).

- Gen Z: More emphasis on gamification, instant gratification (“Get 6 samples for ₹235 + free shipping”), limited-time offers.

- Professionals: Highlight value-for-money, free sampling before buying, smart discovery.

Each segment receives different creatives and CTAs to match their intent and mindset.

- Brands:

- D2C beauty/wellness brands with minimum ₹10–50L marketing budgets.

Priority Channels:

| Channel | Why? | Budget Allocation |

|---|---|---|

Meta/Instagram | High intent audience (beauty/wellness). UGC-friendly. | 50% |

Google Search | Capture "try before you buy" + category-specific queries (e.g., "best serum samples"). | 20% |

YouTube | Unboxing/demo ads resonate with trial-focused users. | 20% |

Programmatic | Retarget engaged users (e.g., visited trial page but didn’t convert). | 10% |

Step 4

Core Messaging:

- For Consumers:

*"Why buy before trying? Get 6 premium beauty/wellness samples for ₹250—100% cashback on your first order!"* - For Brands:

"Acquire high-intent customers at 1/3rd the cost of traditional sampling. Smytten’s AI-driven trials convert 20% to full-size buyers."

Step 5

Creative & Messaging Alignment with User Intent

Intent Type | Creative Hook | CTA Example | Format |

|---|---|---|---|

Discovery (Top Funnel) | “Not sure what suits your skin?” | “Try 6 luxury samples free” | Story/Reel |

Trial conversion | “Loved by 1M+ users. Samples curated for you.” | “Claim your box now” | Carousel/Video |

Post-install nudge | “Still deciding? Your free trials await” | “Complete your trial order” | Retargeting Banner |

| Segment | Message | CTA |

|---|---|---|

Beauty Shoppers | "Try viral serums & makeup before splurging!" | "Claim Your Trial Box Now" |

Wellness Users | "Test protein powders & supplements—only pay if you love them!" | "Get Health Samples" |

Brands | "Reduce CAC with sampled-to-sales conversions. Get a demo!" | "Book a Brand Consultation" |

Step 6

Creative 1 (UGC Video Ad):

- Format: 15-second Instagram Reel.

- Script:

"I never buy blind anymore! With Smytten, I try 6 products for ₹250, get cashback, and only buy what I love. #TryBeforeYouBuy" - Visual: Unboxing + app download CTA.

Creative 2 (Carousel Ad for Brands):

- Slide 1: "Spending ₹500+ to acquire customers?"

- Slide 2: "Smytten’s trials convert at ₹150 CAC (verified)."

- Slide 3: "20% sample-to-purchase rate (industry avg: 5%)."

- CTA: "Partner with us →"

Additional Optimizations & Strategic Suggestions

- A/B testing ads per ICP cohort to tune messaging and visuals (e.g., influencer-style Reel vs static luxury imagery).

- Use app event signals (like add-to-cart, time spent on category) to build high-intent retargeting pools.

- Dayparting: Target working professionals during evening hours, Gen Z during weekends.

- Landing Page Customization: Link each ad to a dedicated landing screen with relevant trial combos based on the creative shown.

(Understand, where does organic intent for your product begins?)

Step 1 → Identify complementary products used by your ICP

Ideal Customer Profile (ICP):

- Demographics: Women 18–35, Tier 1–2 cities, tech-savvy.

- Behavior: Shops online for beauty, wellness, F&B; uses health/fitness apps, payment wallets, and social commerce platforms.

🔍 Key Insight: Users do not come to Smytten to browse aimlessly; they come to solve a need (e.g. "find the right serum", "explore new fragrances") or explore what’s trending in their peer group.

Complementary Products/Services:

- Health/Fitness Apps (e.g., Curefit, HealthifyMe)

- Payment Wallets (e.g., Paytm, PhonePe)

- Social Commerce (e.g., Meesho, Instagram Shopping)

- Beauty Aggregators (e.g., Nykaa, Purplle)

- Food Delivery (e.g., Swiggy Instamart, Zepto)

- Loyalty Programs (e.g., Paytm Rewards, Amazon Pay)

Step 2 → Use the selection framework and compare the potential integrations it in a tabular form.

Step 2: Integration Selection Framework

Evaluation Criteria:

- Strategic Fit: Alignment with Smytten’s trial-to-purchase journey.

- User Overlap: Shared ICP with Smytten.

- Ease of Integration: API availability, partnership complexity.

- Growth Impact: Potential to drive trials, conversions, or retention.

| Integration | Strategic Fit | User Overlap | Ease of Integration | Growth Impact | Priority |

|---|---|---|---|---|---|

Curefit/HealthifyMe | High (Wellness focus) | High (Health-conscious users) | Medium (API-based) | High (Cross-selling supplements) | P1 |

Paytm/PhonePe | Medium (Payment utility) | Very High (All users) | Easy (Payment links) | Medium (Checkout ease) | P2 |

Meesho/Instagram | High (Social commerce) | High (Value shoppers) | Hard (Custom partnership) | High (Virality) | P1 |

Nykaa/Purplle | High (Beauty focus) | Very High (Beauty shoppers) | Hard (Competitor tension) | Medium (Upsell trials) | P3 |

Swiggy Instamart | Medium (F&B trials) | Medium (Urban users) | Medium (Co-branded kits) | High (New categories) | P2 |

Paytm Rewards | Low (Indirect benefit) | High (Existing users) | Easy (Loyalty points) | Low (Minor retention) | P4 |

Step 3 → Collaborate with necessary stakeholders

Step 4 → Map the customer journey

Step 3 → Design the wireframe with the new integration

Step 3 → Run pilot tests before launching

Step 3 → Measure post-integration metrics

P1: High-Impact, High-Fit

- Curefit/HealthifyMe

- Tactic: Offer "Free Smytten Trial Box" with annual subscription.

- Outcome: Access to health-focused users → cross-sell wellness samples.

- Meesho/Instagram Shopping

- Tactic: Embed Smytten trials as "add-ons" in social commerce orders.

- Outcome: Viral sampling via social buyers.

P2: Medium-Impact, Scalable

- Paytm/PhonePe

- Tactic: "Cashback on Smytten trials" via payment wallet promotions.

- Outcome: Boost trial sign-ups via payment traffic

Justification for Each Integration (Linked to User Behavior)

Platform | Why Integrate (User Behavior Driven) | Acquisition Benefit |

|---|---|---|

Curefit | Users are health-conscious, urban, app-savvy; overlap with personal care buyers | Taps into wellness-first ICP; trial samples in app can drive installs |

Meesho | Value-driven shoppers seeking low-cost discoveries; overlap with Gen Z & Tier 2 users | Access to aspirational but budget-seeking audience; trial pack ads in feed |

Instagram Shopping | Visual-first, impulse buyers; core Smytten ICP (18–30, beauty/lifestyle focused) | Direct product-to-app journey with shoppable trials via influencer/shop posts |

PhonePe & Paytm (Cashback/Wallet) | Price-sensitive, deal-hungry users; mobile-first behavior | Reward trials or purchases with cashback, increasing conversion + installs |

Zepto/Swiggy/Instamart

(optional idea) | Habitual quick-commerce users; instant gratification behavior | Embed trial SKUs as surprise add-ons or via trial packs in impulse carts |

Integration Formats & User Experience Flow

A. Curefit App Integration

- Flow: Post-workout → offer “Free Wellness Kit powered by Smytten” → click → redirect to Smytten app → reward with 6 free trials

- Behavioral Justification: Leverages moment of health-high; aligns with intent to explore self-care products

- Value: Targeted, conversion-ready traffic; lower CAC than cold paid ads

B. Meesho Integration

- Flow: Banner or influencer-led push in beauty section → “Try 6 branded products for ₹235” → one-tap redirect

- Behavioral Justification: Taps aspirational demand for premium products at Meesho pricing logic

- Value: Increases reach in Tier 2/3 where ad CPMs are rising

C. Instagram Shopping

- Flow: Swipe-up on Reel or shoppable post tagged with Smytten trial SKUs → deep link into Smytten trial box screen

- Behavioral Justification: Impulse purchases from trend-led, aesthetic-first shoppers (core ICP)

- Value: Improves ROAS by making Instagram organic/paid posts conversion-friendly

D. PhonePe / Paytm Cashback Integration

- Flow: Offer ₹25–₹50 wallet cashback when completing a Smytten order via PhonePe or Paytm

- Behavioral Justification: Incentivizes price-sensitive first-time users to complete trials

- Value: Reduces drop-offs at checkout and improves CAC:LTV conversion metrics

Why This Strengthens Acquisition Strategy

- Lower CAC: Acquiring users via contextual integrations (vs paid ads) significantly reduces cost per install.

- High-Intent Traffic: Users on Curefit or Meesho are already primed for health, beauty, or budget-conscious discovery.

- Better LTV Fit: Integrated users show better match with Smytten’s monetizable segments (trial-to-full-size journey).

- Brand Halo Effect: Being seen on trusted apps like Curefit or PhonePe increases Smytten’s perceived credibility.

Strategic Role in Acquisition Funnel

Funnel Stage | Integration Example | Strategic Impact |

|---|---|---|

Top Funnel | Curefit, Instagram Shopping | Reach intent-led users during high-engagement moments |

Mid Funnel | Meesho, Instagram | Persuasive sampling as low-risk entry |

Bottom Funnel | PhonePe/Paytm Cashback | Nudge hesitant users to complete trial order |

(For B2B companies, if referral does not make sense you'll take a crack at a partner program for your product)

Step 1 → Flesh out the referral/partner program

Step 2 → Draw raw frames on a piece of paper to get the gist.

(Don't spend a lot of time on design. This is for you to communicate how the referral hook will look)

- All registered Smytten users are automatically enrolled.

- Referral codes/links are available inside the app and website.

How It Works

🔗 Step 1: Share Your Referral Code

- Each user gets a unique referral code/link.

- Can be shared via WhatsApp, Instagram, email, SMS, or directly from the app.

🎁 Step 2: Friend Joins Using Your Code

- The referred user must sign up via the referral link or enter the referral code during registration.

🧴 Step 3: Referred User Gets Free Trial Points

- New users get ₹199 worth of trial points or 6 trial points (as per current model).

- Additionally, they get free shipping on their first trial order.

💸 Step 4: Referrer Gets Rewarded

- Once the referred user places their first order (trial or paid), the referrer gets:

- ₹50 wallet cashback, or

- 5 trial points, or

- ₹100 off coupon for purchases over ₹499

- Bonus: Refer 5 friends and get an extra ₹250 wallet bonus or exclusive brand freebies.

Marketing Campaign Ideas

- “Refer 3 Friends, Get a Mystery Trial Box”

- Social challenges: “Screenshot your rewards, tag us, and win bonus points.”

- Limited-time multipliers: “Double rewards this week only!”

Referrer journey

Stage | Action Taken | User Experience (UX) | System Triggers & Backend |

|---|---|---|---|

Awareness | Sees referral prompt in app, email, or SMS | Banner or popup: "Refer & Earn Rewards" | Analytics logs view event |

Consideration | Checks benefits of referring | Sees tiered reward structure & T&Cs | Backend fetches referral stats |

Action | Shares referral code/link | Shares via WhatsApp, Instagram, etc. | Unique referral link generated |

Wait/Monitor | Waits for friend to sign up | Notification center shows pending referrals | Backend tracks link usage |

Reward Trigger | Friend signs up and places first trial/purchase | Gets notification: “You earned ₹50 cashback!” | Wallet or trial points updated |

Post-Action | Uses reward on purchase or trial | Feels rewarded; more likely to refer again | Usage recorded for retention analysis |

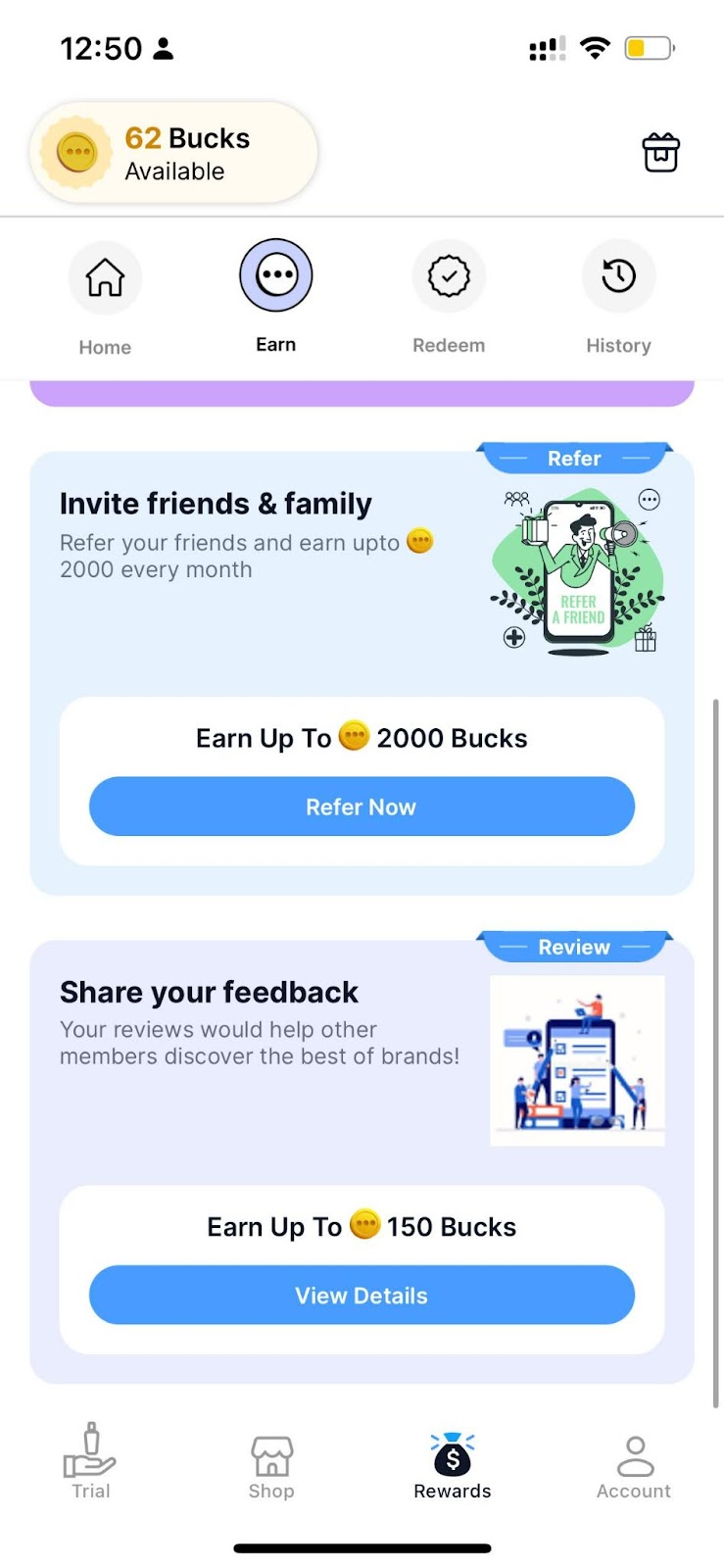

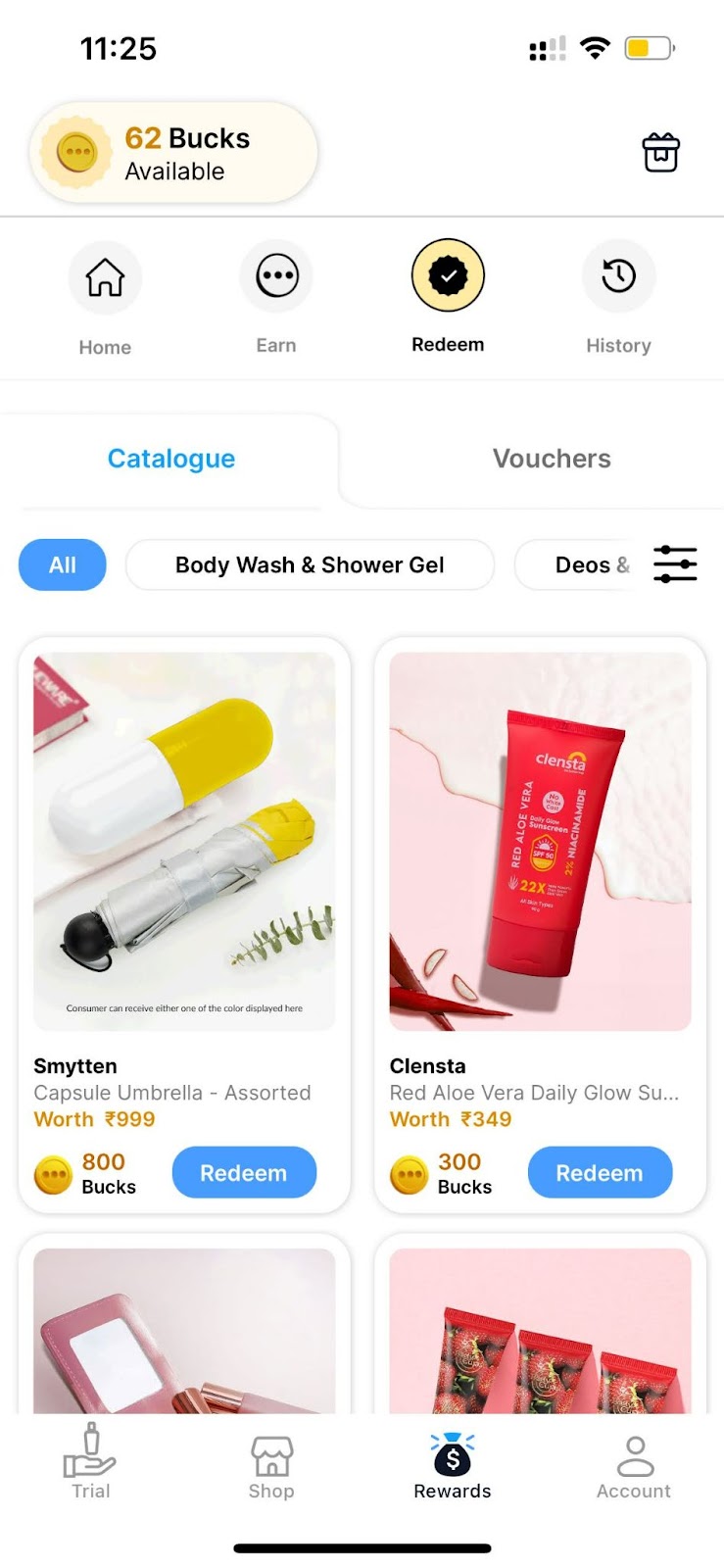

Referral:

Platform rewards (called Smytten bucks) can be earned on successful referrals, which are then redeemed against a catalogue of products.

A good referral program doesn’t just offer rewards — it taps into why people refer. Currently, Smytten's referral strategy under-leverages:

A good referral program doesn’t just offer rewards — it taps into why people refer. Currently, Smytten's referral strategy under-leverages:

- Social currency: "I discovered something cool you should try"

- Personal benefit: Getting rewarded when a friend tries a product

- Gamified pride: Seeing referral counts go up (status = micro-influence)

- Motivation-Based Segmentation

ICP Segment | Key Referral Motivation | What Reward Resonates Most |

|---|---|---|

Gen Z (18–24) | Wants to be first to share cool things, loves gamification | Extra trial credits, leaderboard badge, early access |

Young Women (25–30) | Wants to share good finds in beauty/wellness | Premium trial samples, exclusive brand boxes |

Value Seekers | Seeks rewards and cashback | ₹ credits, extra discount on next box |

Enhanced Referral Journey (With Engagement Hooks)

Stage | Current Flow | Revised Strategy (Behaviorally Optimized) |

|---|---|---|

Prompt to refer | Static in-app banner | Dynamic referral nudge after positive moment (e.g., after receiving a trial box or writing a review) |

Referral sharing | Link copy and share | Pre-filled message + emoji packs + Instagram story templates |

Reward reveal | ₹50–₹100 wallet credit | “Scratch card” reveal to gamify and add surprise element |

Progress feedback | No ongoing loop | Add referral tracker: “You’ve referred 3 friends. Refer 2 more to unlock early access to X brand.” |

Additional Ideas to Scale the Program

Additional Ideas to Scale the Program

- Tiered Referral Milestones:

- Refer 3 → get free trial

- Refer 5 → get full-size product

- Refer 10 → unlock premium membership for a month

- Influencer-style Referral Cards: For power users to share stylized cards (e.g., “Smytten Curator” badge)

- Festival/Drop Campaigns: “Smytten Rakhi Drop – Refer a sibling, both get a gift box”

How This Drives Acquisition More Effectively

- Increased Virality: Tapping into FOMO and social proof with story templates and post-trial sharing prompts

- Better Conversion: Giving referees instant gratification (e.g., free trials, not just wallet credit)

- Higher Retention: Users who refer feel more invested → better LTV cohorts

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.